Get the free sdrs form e 5

Show details

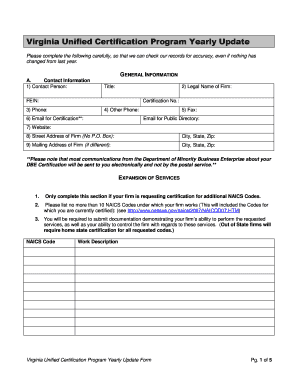

Beneficiary Designation Form South Dakota Retirement System PO Box 1098 Pierre, South Dakota 57501-1098 Phone (888) 605-SDRS (605) 773-3731 FAX (605) 773-3949 SARS Form E-5 Member Information (Please

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your sdrs form e 5 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sdrs form e 5 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sdrs form e 5 online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sdrs form e 5. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out sdrs form e 5

How to fill out sdrs form e 5?

01

Obtain the sdrs form e 5 from the appropriate source, such as the relevant government agency or website.

02

Read the instructions carefully to understand the purpose and requirements of the form.

03

Provide all necessary personal information, such as name, address, date of birth, and contact details, in the designated fields.

04

Complete the sections related to the specific information being requested, such as employment history, educational background, or financial details.

05

Ensure all information provided is accurate and up-to-date. Double-check for any errors or omissions before submitting the form.

06

Sign and date the form as required, certifying the accuracy of the information provided.

07

Make a photocopy of the completed form for your records, if necessary.

Who needs sdrs form e 5?

01

Individuals who are seeking assistance or benefits from the relevant government agency or organization may need to fill out the sdrs form e 5.

02

Applicants for certain programs, such as social welfare, healthcare, or financial aid, may be required to complete this form.

03

Specific eligibility criteria will determine who needs to fill out the sdrs form e 5, as it serves as a means to collect necessary information for the processing of applications or assessments.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sdrs form e 5?

SDRS Form E-5 is an application form used by the South Dakota Retirement System (SDRS) to initiate a disability retirement application. The form requests information about the applicant's medical condition, employment history, and other relevant information.

Who is required to file sdrs form e 5?

The Self-Directed Retirement Savings (SDRS) Form E-5 is a form that must be completed and filed by third-party administrators that are responsible for administering a self-directed retirement plan, such as a 401(k) or IRA.

How to fill out sdrs form e 5?

1. On the top of the form, fill out the date and purpose of the form.

2. In Section I, list the details of the service member including rank, name, social security number, date of birth, and branch of service.

3. In Section II, list the details of the service member's current duty assignment including the name and address of the command to which they are assigned.

4. In Section III, list the service member's qualifications for the duty station to which they are assigned, including any special qualifications or certifications.

5. In Section IV, list the service member's professional performance record, including any awards, commendations, or disciplinary actions.

6. In Section V, list the service member's education and training, including any special courses or schools completed.

7. In Section VI, list any pending or planned assignments that the service member is expected to undertake.

8. In Section VII, list the service member's personal qualities and characteristics, including any leadership or management skills.

9. In Section VIII, list any comments or recommendations from the service member's commanding officer.

10. Sign and date the form before submitting it.

What is the purpose of sdrs form e 5?

The SDR Form E-5 is used by the Small Business Administration (SBA) to document the transfer of an SBA loan from one lender to another. The form is used as part of the process of transferring an existing loan from one lender to another and is intended to ensure that all required information is collected and accurately transferred between the two lenders.

When is the deadline to file sdrs form e 5 in 2023?

The deadline for filing SDRs Form E 5 in 2023 is June 30th, 2023.

What is the penalty for the late filing of sdrs form e 5?

The penalty for late filing of SDRS (Summary Data Return System) Form E-5 may vary depending on the jurisdiction and specific regulations in place. It is advisable to consult the relevant authority or legal counsel to obtain accurate and up-to-date information on the specific penalties and consequences for late filing of this form.

What information must be reported on sdrs form e 5?

Form SDRS E-5 is used to report information about a company's securities holdings as required by the Securities and Exchange Commission (SEC). The specific information that must be reported on this form includes:

1. Reporting Person: Name, address, and relationship to the issuer (company).

2. Issuer Information: Name and address of the company whose securities are being reported.

3. Title and Class of Security: Description of the security, such as common stock, preferred stock, or debt securities.

4. CUSIP and Ticker Symbol: Unique identifiers for the security.

5. Amount of Security Owned: Number of securities owned by the reporting person.

6. Reporting Person's Ownership Percentage: The percentage of ownership in the company's securities held by the reporting person.

7. Date of Event Requiring Statement: The date when the reporting person acquired or disposed of the securities.

8. Nature of Indirect Beneficial Ownership: If the reporting person does not directly own the securities but has indirect beneficial ownership (through partners, trustees, or other entities), it must be reported.

9. Source and Amount of Funds or Other Considerations: The source of funds used to acquire the securities, such as personal funds, loans, gifts, or stock options.

10. Purpose of Transaction and Plans or Proposals: Explanation of the purpose for acquiring or disposing of the securities, including any future plans or proposals regarding the holdings.

11. Signature and Date: The reporting person's signature and the date of signing to certify the accuracy of the information provided.

It is important to note that the requirements for reporting on Form SDRS E-5 may vary depending on the specific circumstances and the regulations set forth by the SEC.

How do I complete sdrs form e 5 online?

pdfFiller has made it simple to fill out and eSign sdrs form e 5. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How can I edit sdrs form e 5 on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing sdrs form e 5.

How can I fill out sdrs form e 5 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your sdrs form e 5 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your sdrs form e 5 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.